COVID-19 is the biggest disruptor in modern travel history. It has shown its might in closing borders, grounding planes, and restricting movement on a scale never seen before.

But we’re learning to live with the virus. Although restrictions are still in flux, planes have returned to the skies, hotels are re-opening their doors, and there’s more vehicles on the roads again.

And people? People are eager to visit friends and relatives, take a much-needed break, or simply return to some normality. But the situation is complex, and ever-changing. As consumers, they need to feel informed, with reassurance that travel is safe, flexible, and transparent.

The industry now needs to understand exactly what safety protocols will encourage bookings, then implement these measures, and find the best ways to get that message out to consumers.

We developed this guide to share the latest research-based perspectives from travelers, suppliers, and agencies, and to address the pressing questions the travel industry is asking right now. This includes:

- what safety measures are most important to travelers, and if implementing them will restore enough confidence to influence them to book.

- the measures travel suppliers are taking to make travel safe, and if they align closely with what travelers want.

- how all of this impacts the way travelers perceive the role of, and interactions with, travel agencies in the booking process.

- what are the first commercial opportunities that are emerging as recovery gets underway.

- how we, as an industry, can act collectively to accelerate recovery.

Our approach

We conducted different types of research — both quantitative and qualitative — across three key categories:

- Travel providers

Travelport first conducted quantitative research surveying 100 leading airlines, airports, hotels, and car rental companies to identify the safety measures they have in place today or are considering. We also ran qualitative interviews with 29 of our supply partners (also including tourism boards) to get more insight on how recovery is taking shape for them, as well as their expectations for the future. - Travelers

We also tested demand for the most commonly cited initiatives through an online survey independently managed by Toluna Research. The study took place in July 2020. In total, there were 5,000 respondents who had traveled at least once in 2019. The five countries included in the study were: United States, United Kingdom, India, Australia and New Zealand with 1,000 respondents per country. - Travel agencies

Finally, Travelport also conducted qualitative research with six leading agency partners, plus several C-suite executives, to assess how changing traveler needs are affecting them, and how they are driving recovery. Our findings reflect the perspectives shared across agencies, online travel agencies (OTAs), and travel management companies (TMCs).

All figures and findings throughout this guide are taken from the research above and reflect traveler, agency, and partner sentiment as of July 2020. Travelport’s own data has also informed some trends and views around recovery. Quotes included from our supply and demand side partners in this guide are taken from our Recovery trends in travel webinars across APAC, EMEA and the Americas, which you can listen to here.

Throughout this guide we’ve included broad perspectives on what has changed from the traveler point of view and how this is affecting both travel products and customer experience. Our hope is that the findings will help you to make informed business decisions, seize commercial opportunities, and to identify the ways to facilitate recovery.

01

Air

The aviation industry has dominated headlines since air traffic ground to a halt in March this year. While these have been incredibly tough times for airports, airlines, and other aviation sector businesses, we are now starting to see green shoots emerging as borders reopen.

As travelers return to the skies, safety and hygiene are now airlines’ primary focus. In May, the World Travel and Tourism Council (WTTC) published a set of safety protocols for the aviation sector, to help provide a coordinated approach to flying, that’s supported by medical evidence. To achieve true recovery, airports and airlines now need to understand travelers’ expectations in a COVID-19 world and implement new measures to restore confidence in travel.

Traveler research: Key findings

Overall, travelers want as many safety measures in place as possible, with most of the proposed cleaning and hygiene measures seen as important factors in restoring confidence. Our research shows encouraging signs that there is still a willingness to fly, as long as these measures are in place at key points in the customer journey.

Restoring traveler confidence

Airlines have acted fast to introduce new safety measures and make changes to their policies to restore traveler confidence and kickstart recovery. During our qualitative research, our airline partners noted that for the vast majority, customers seem happy to follow these measures, and feel reassured by them.

Overall, more than half of travelers said that they will consider booking a flight if they know in advance that stringent safety measures have been implemented by the airline and airport.

Airports and related touchpoints

In terminal

- Our airline partners think that airports should guarantee that common spaces will be comfortable and allow for social distancing. Otherwise, people won’t travel even if the carrier itself is safe. This means frequent disinfection of touch surfaces, installing plexiglass at counters, mandatory face coverings for employees and passengers, and anticipating more time for passengers at the airport.

- Lounges are likely to reopen very slowly throughout the coming months. The closure of lounges is less of an influencing factor for travelers than some of the other points, with only 39% saying this is ‘very important’ and 31% saying it is ‘nice to have’. Overall, only 8% of people said they did not want lounges to close.

Temperature checks

- With 66% of travelers rating temperature checks as important, this is likely to become standard procedure in air travel until a vaccine is developed.

- Most carriers say that the most logical approach is for checks to be done by scanner before the passenger goes through security, even on entry into the airport. This would help to avoid potentially infected people waiting in crowded lines.

- Airlines carrying out temperature checks at boarding gates is not an ideal solution — the passengers have already queued multiple times to complete their journey through the airport, and carrying out pre-flight infra-red temperature checks for every customer may be a logistical challenge for some airlines. Many of our airline customers are pushing for governments to devise solutions for this, and for airport authorities to perform temperature checks much earlier in the process — such as initial arrival at the airport.

Check-in

- 58% of travelers want self-service online check-in via mobile/tablet/online or contactless check-in

- Our air partners anticipate an overall increase in the use of contactless technology, including touchless check-in, the ability for passengers to use their mobile device while at a kiosk but without touching the kiosk or screen itself.

- In airports where an airline has more presence, they are typically spacing out the check-in desks and allowing only one person from the party or group complete check-in.

Boarding

- Our airline partners say some departure gates will now close 30 minutes before take-off, preventing last-minute arrivals and to enable physical distancing while boarding. Roughly half (47%) of travelers rated closing departure gates early as ‘very important’. Managed boarding by row, was ‘very important’ to 56% of our respondents.

- Airlines and airports are putting physical distancing markers on the floors at check-in areas and boarding gates. They are also increasing their cleaning efforts at gates and following a new process for boarding and disembarking.

- On many routes, customers are being asked to fill out a medical form to self-certify that they are safe to fly and are not sick. However, some partners have expressed a concern that health screening questions may pose a challenge in Europe due to GDPR laws.

- Some airlines are taking temperatures at check-in, and again at boarding, to avoid having unwell people progressing through the airport.

Onboard product and experience

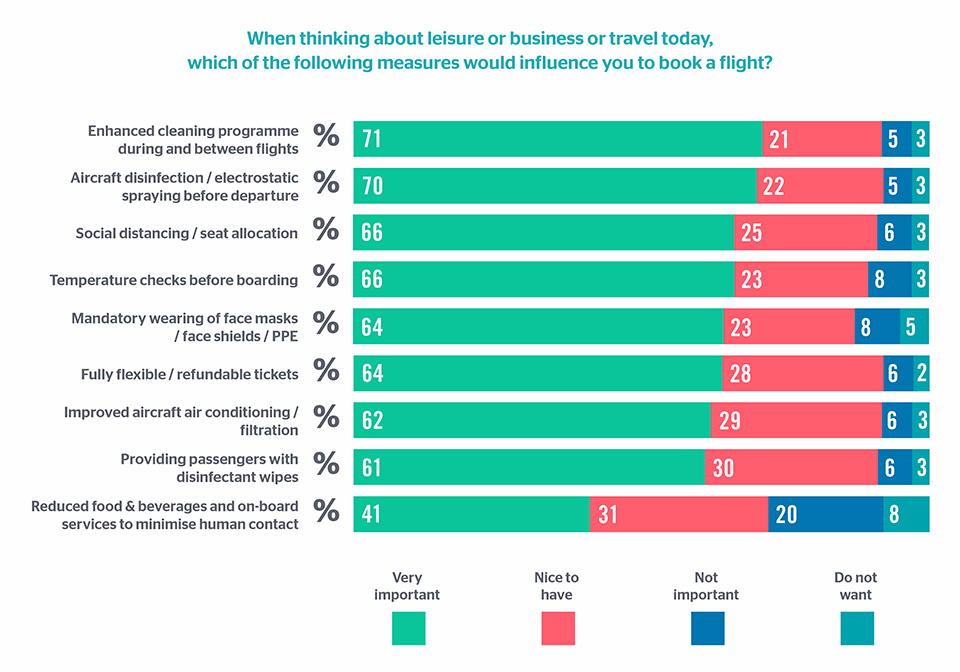

Our research shows that cleanliness and flexibility are the most important factors that would influence travelers to book a flight for business or leisure right now.

Craft cleanliness & hygiene factors

- 71% of respondents say an enhanced cleaning program during and between flights is the most important factor that would influence them to book a flight.

- As with the in-airport safety and hygiene measures proposed, travelers are also receptive to all of the measures proposed for onboard the plane, with the majority finding all of these ‘very important’ or ‘nice to have’.

- In line with this, airlines are implementing multiple cleaning measures. This includes sanitizing the plane before departure and, as a result, having a longer turnaround times at the airport. Overnight, there is usually an extra deep-cleaning of carpets, seatbacks and other high-touch areas. Some airlines are also applying an electrostatic or disinfectant fog or spray to all interior surfaces. And, 70% of respondents said this type of cleaning was a very important factor that would influence them to book a flight.

- HEPA (hospital grade) air filters cycle air every 2-4 minutes, greatly improving air quality and sanitation. The vast majority of commercial airliners either use HEPA filtered air, or external air. Many airlines are cleaning and replacing filters more often than required by CDC standards, and 62% of respondents said this was very important to them.

- Onboard products such as pillows, blankets, and magazines have been removed by some carriers, or made available on request only.

People cleanliness & hygiene factors

- Generally, our airline partners’ crew are wearing masks and gloves, and — in some cases — gowns and face shield PPE. Depending on the airline and market, passengers are either encouraged or required to wear masks for the duration of the journey. 64% of travelers said this was a ‘very important’ influencing factor they would consider when booking. Some airlines are providing masks.

- Some airlines are providing disinfectant wipes to passengers. 61% of travelers said this was ‘very important’ when considering booking.

- Changes have been made to in-flight services to reduce contact between passengers and crew including: refreshments by request only, drinks served in cans not glasses, individual water bottles instead of bar service. And, pre-packed meals frequently have a new quality or safety stamp.

- On many shorter flights, meal and snack services have been suspended entirely. However, reducing services that involve human contact, like food service, have relatively less of an influence on travelers’ willingness to book a flight, with 41% citing the reduction as ‘very important’.

The safety of our travelers is priority number one as we are planning to return to the skies. We’re cleaning the aircraft over six hours, every single night, touching every customer surface. We’re ensuring distancing during our boarding process, keeping our mddle seats open through at least September 30, and making preparations to even extend that if needed. We’re trying to just take the ultimate caution in being safe with our travelers and our employees. It’s something that we think is absolutely critical in this time and we are proud to offer it to all of our travelers

Social distancing

- 66% of travelers said that social distancing/seat allocation was a ‘very important’ influence on whether they would book a flight.

- Generally, airlines say that from a commercial standpoint it is not viable to block all middle seats. Some airlines will offer middle seats last, but if the aircraft fills, they will still sell them. Some are choosing to inform passengers in advance when the flight is nearly full and offering the ability to change flight for free. Most airlines can’t guarantee that any given seat will remain empty.

- Regardless of load factor, most airlines are arranging seating to maximize social distancing as much as possible. Limited movement while in the air is encouraged. While disembarking, the focus is on maintaining order by asking people to stay seated until the row ahead is clear.

- Domestic flights are more manageable, however international travel will raise more complexities since passengers spend more time on board, and it is even less commercially viable to keep the middle seat free.

- In our qualitative research, one airline mentioned that they are encouraging family bookings through new dedicated offers such as a companion passenger at a discount, since households have no need to socially distance.

What safety measures are perceived to be short-term?

- 41% of airline respondents expect a reduced catering service to be in place for less than one year.

- Of the 85 airlines we check for our COVID-19 safety tracker, only 8 were still blocking the middle seat in August.

Source: Travelport quantitative research

What measures will need to remain in place until a vaccine is available?

- Almost a third of respondents expect plexiglass and self-certification measures to be in place until a vaccine solution is developed.

Source: Travelport quantitative research

What safety measures are likely to be adopted as the ‘new normal’ in the future?

The general perception is that the ‘new normal’ (i.e. the immediate future and beyond, and also once COVID-19 has been resolved definitively), will embrace deeper cleanliness and also speed up the adoption of contactless, biometric and ultimately more technological solutions within the customer journey.

- 40% of airlines expect an enhanced cleaning program between flights to become the new normal.

- 31% believe that electrostatic cabin spraying will be adopted long-term

- 56% expect self-service to be rigorously adopted.

- 36% think biometric and contactless processes are here to stay.

Source: Travelport quantitative research

Data from our Airline safety measures tracker tool shows that, of the 85 airlines we cover:

- Most airlines require masks or face coverings to be worn.

- 55 out of 85 airlines indicate that they (or airport or government) will check passenger temperatures.

- 52 out of 85 airlines require some kind of health certificate or self-declaration prior to travel.

- 81 (95%) have implemented extra cleaning or disinfection of aircraft.

- 68% have reduced onboard services.

Customer service

Amending policies to give more flexibility

- 64% of people surveyed said that fully flexible/refundable tickets is a ‘very important’ factor that would influence them to book a flight.

- Our airline partners are aware that because the situation is constantly changing, customers will not book if they do not have the flexibility to change their flights without incurring fees. This also applies to extending tickets or cancelling them but also retaining their value towards future bookings. Some airlines are informing passengers (in advance of traveling) when the flight is nearly fully booked and offering the ability to change flights for free.

- While this is being well received by travelers and travel agencies, agents have struggled to keep up with the added challenge of finding and communicating this information, particularly at the beginning of the crisis when they experienced a high volume of changes.

- 68% of our airline partners that we surveyeds believe that the ‘No flight change fee’ will be necessary for between 3 months – 2 years.

Communication

Communicating all of the changes made to the on-board product and experience, and across all related touchpoints, is key. Sanitization and cleaning procedures should be well documented through videos, social media, dedicated sections on websites, and via apps and emails.

Most airlines are trying to communicate with passengers in advance to let people know what to expect before going to the airport, from safety measures to what retail/food and beverage units are open. Passengers particularly need to be notified about new boarding processes, plus, if their flight goes above a certain threshold of load factor, to allow them to decide whether to change their itinerary or fly anyway.

These passenger experience changes need to be communicated to agencies to support the sales process. From conversations with our agency customers, we understand that keeping on top of the latest safety and comfort updates that airlines are putting in place has been a significant challenge.

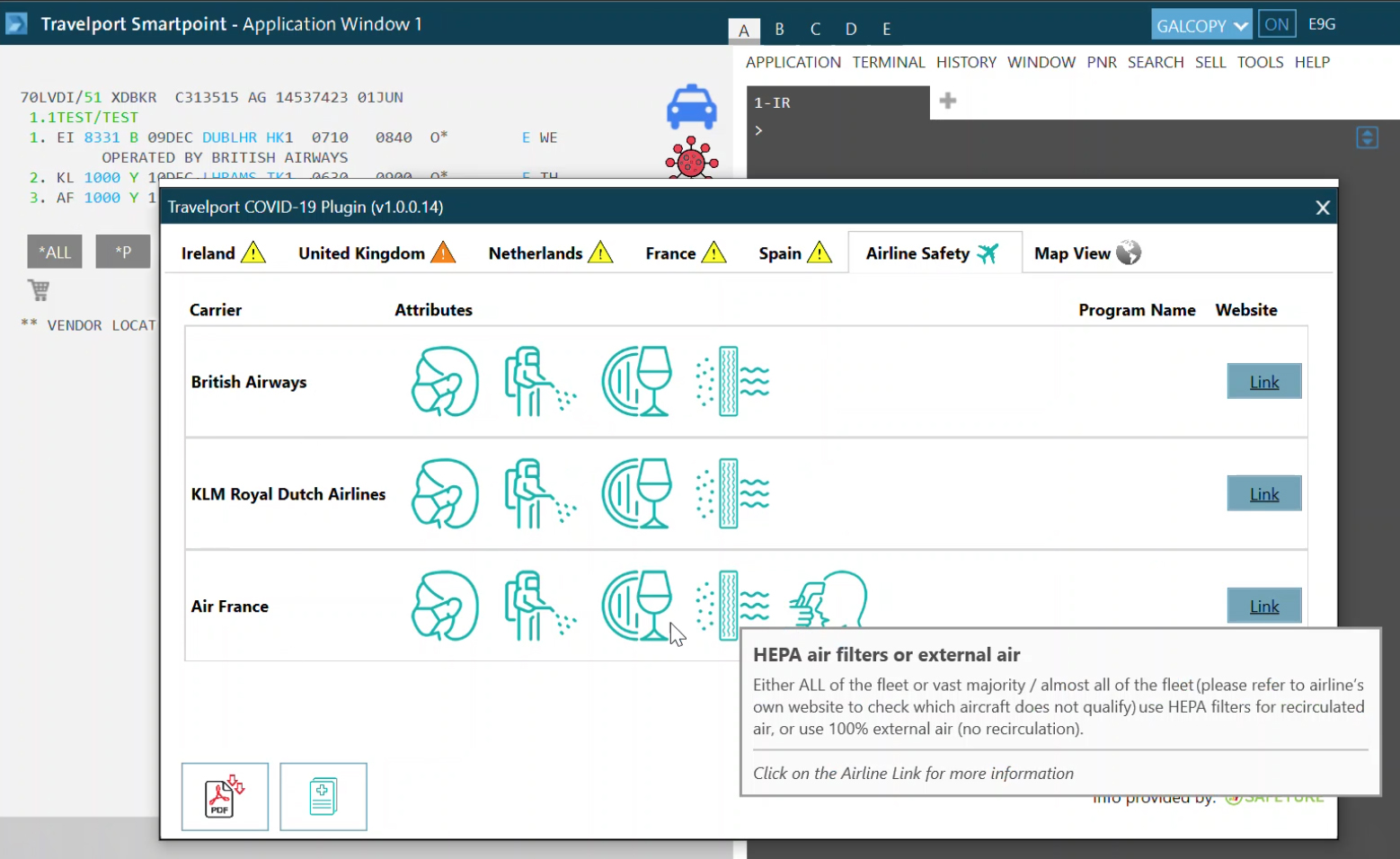

We created the Airline Health & Safety tracker to help inform agents and consumers what to expect when travelling with 80+ airlines globally.

We need to understand what corporate travelers are demanding versus leisure. So, we’re putting more emphasis on educating and building confidence in the customer in terms of how safe air travel is. We’re working with manufacturers to show how air is filtered through the aircraft, to make sure that our customers are aware and confident that air travel is still safe.

Airline recovery strategies

Leveraging data

Airlines are spending considerable time understanding what data can tell them about recovery trends. Airlines are also looking at what they can do with their websites. loyalty programs, marketing, sales and pricing — with all teams working in sync to help drive demand generation, informing operations and how that drives changes.

We asked our air partners what data they are using to identify recovery trends:

- 89% are reviewing their own website data.

- 70% are studying existing customer data.

- 76% considering forward bookings.

- Meta search and OTA data is still being reviewed but not as intensely.

Source: Travelport quantitative research

Travelport has been contributing to the data story by analyzing our week-over-week indexed view of gross traveler behaviors based on those transacting through the GDS for air and hotel products. This will help airlines across APAC, EMEA, and the Americas regions understand more about who is traveling and where they are going.

Enabling more self-service

Many airlines have significantly reduced headcount or furloughed staff, reducing their ability to service customers, and any future increase in staff will be linked to the strength of recovery. Given that initial call volumes were unmanageable, airlines have launched or increased their use of chat functions and are looking at optimizing digital interfaces to allow customers to self-serve as much as possible. This will also help to limit in-person interactions with staff on their journey.

Using dynamic pricing

Some carriers are adopting the ‘cheap flight’ approach to drive demand although there are concerns about the economic sustainability of this approach. Most airlines want to focus on getting a high return per booking, even when volume is low.

In the short-term pricing should go up, because otherwise you have this whole mismatch of demand and supply. Eventually we will reach a new equilibrium, where you just have to have capacity, and you have enough demand. But pricing needs to go up for business to make sense.

Maintaining a reliable shopping and booking experience

While airlines recognize that change could help in the future, right now due to reduced resources and time, servicing customers alone is overwhelming many carriers. Most airlines are saying they want to continue or accelerate their API and NDC connectivity programs — even in circumstances of reduced resources — as they believe that this will enable long-term recovery through retailing opportunities and data. However, some of these projects may be temporarily delayed as airlines prioritize recovery.

As was the case before the crisis, airlines will continue to invest in the digital space, making the booking process as easy as possible. But no major changes are planned for the shopping experience. And, driving adoption will remain a key focus for mobile.

In terms of trends, both online and offline bookings are low, but online has higher than normal share. Airlines say that further analysis is proving difficult due to reduced staff numbers.

Making changes to capacity

Airlines are exercising caution when it comes to capacity, only offering supply when demand is there. Full-service carriers will need to review their pricing proposition to ensure it covers variable costs. Given the expectation that corporate travel may be slower to return than leisure and small and medium enterprises (SMEs), premium travel products need to be carefully monitored. On the whole, we are seeing capacity, demand, and passenger numbers creeping up across the industry.

What will be the major changes to your schedule, capacity, network and network partnerships post COVID-19?

- 39% will be restructuring their schedules. This aligns with the restructuring of connecting / feeder traffic (c. 46%), with 33% looking to restructure intermodal arrangements.

- At least in the short term, 50% will see a reduced schedule and 48% reduction in capacity.

- 41% aren’t expecting any changes in network/interline partnerships, and the alliance relationships are unlikely to change for 39%.

Source: Travelport quantitative research

Maintaining engagement with customers and the wider industry

Airlines are looking at creative ways to connect to their customer base through online activities like tours, concerts, or cooking classes. They also recognize the need to collaborate closely with trade and tourism partners on how to get travel and tourism moving again.

We believe price is not a factor for us in driving demand at this point, because even if the price is low, but the customer’s not comfortable flying, demand won’t be there. So, instead we’re looking at the demand, pricing, fuel efficiency, cost efficiency, fleet schedule.

02

Hotel

With restrictions lifting and domestic travel showing signs of recovering fastest, hotels are in a good position to start their recovery journey. They stand to benefit first from the pent-up demand among travelers wanting to visit friends and relatives in different regions of their home country.

As with other areas of the industry, safety and hygiene are now top of mind for hotels. In May, the World Travel and Tourism Council (WTTC) published a set of safety protocols for the hospitality sector, to help provide a coordinated approach to reopening that’s supported by medical evidence. The WHO has also developed a set of guidelines a set of guidelines to support hotels as they begin to slowly return to business. An additional organization, American Hotel & Lodging Association (AHLA) has developed Safe Stay®, an industry-wide initiative focused on enhanced hotel cleaning practices, social interactions, and workplace protocols to meet the new health and safety challenges and expectations presented by COVID-19.

Traveler research: Key findings

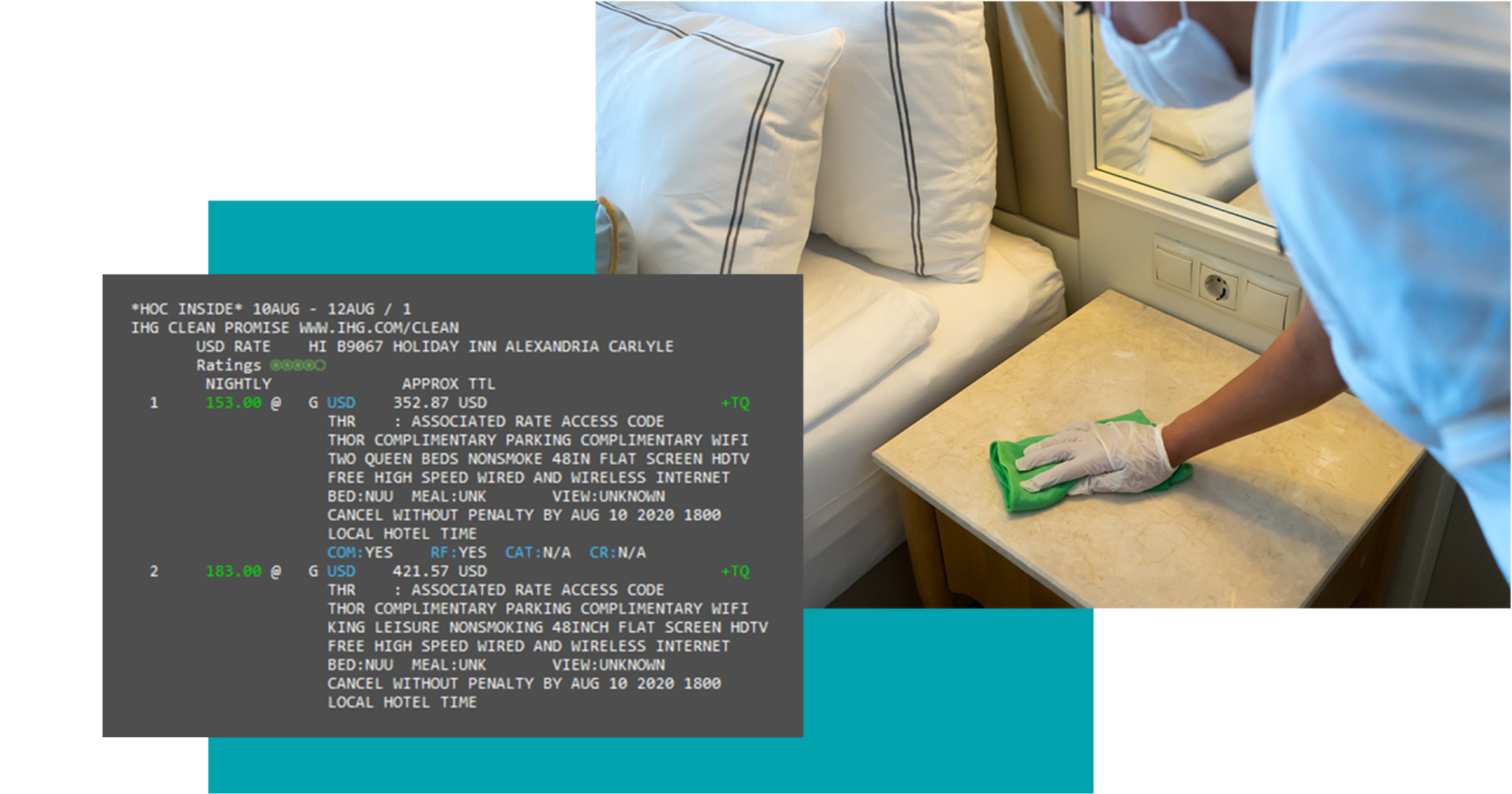

Overall, we are seeing that safety is paramount in building confidence to travel and that travelers simply want as many of these measures in place as possible. Our traveler research is showing that the safety measures hotels are undertaking are aligned to what travelers need to restore their confidence.

Restoring traveler confidence

Our research with travelers shows encouraging signs that there is still a willingness to stay in a hotel, assuming safety measures and policies are in place. Hotels have acted fast to introduce new safety measures and make changes to their policies to reassure travelers and kickstart recovery.

Most travelers said the safety measures that will give them the confidence to book a room in a hotel are as follows:

Sanitation/cleanliness

- Most hotels have implemented additional cleaning measures, with many adding seals to room doors to indicate no one has entered since being thoroughly cleaned. They are also disinfecting frequently used and public areas more often and de-cluttering items like books or newspapers to reduce the potential for transmission of COVID-19. This was ‘very important’ to 73% of travelers.

- Most of our hotel partners are providing staff with PPE and additional cleaning equipment on-site. 64% of travelers say this measure would give them confidence to stay in a hotel.

- They are also reassuring customers that cleaning products, like disinfectant wipes and hand wash, will be available. This was ‘very important’ to 70% of people. Some hotels are requiring customers to wear a mask during their stay or arrival.

- Some hotels are installing plexiglass barriers at various desks and increasing disinfection of frequently touched areas like check-in counters and kiosks. They are also implementing distancing lines for waiting areas.

- Several partners would welcome industry regulation that would provide mandatory measures to level the playing field and ensure a secure customer experience. However, it would need to be consistent in different cities, states, and countries.

Minimizing touchpoints on arrival

- Almost all our hotel partners expressed an interest in reducing the number of physical touchpoints required as part of the check-in/collection experience by travelers. They will be increasing efforts to use self-service check-in (via mobile/tablet /online) to reduce the use of kiosk or desks, as well as more contactless payment solutions. 58% of people found contactless check in/out/room selection to be ‘very important. To enable this, hotels will need as much crucial customer information as possible in advance of arrival.

- With 51% of travelers saying they want to see guest services available from mobile devices, hotel partners have a renewed focus on digital key solutions and advance selections, including room selection.

What are perceived to be the short-term safety measures?

- 41% of hotel respondents expect lower occupancy levels to be the largest short-term safety measure they will have to implement as a result of COVID-19.

- In this quantitative research only 23% of hotels surveyed saw obligatory face coverings on site as important, yet in our qualitative interviews we found that some of our hotel partners are requesting guests and staff to wear them on arrival or within the premises. 64% of travelers said it was ‘very important’ to them that staff wear masks.

Source: Travelport quantitative research

What safety measures are likely to be adopted as the ‘new normal’ in the future?

The perception is that the ‘new normal’ will embrace deeper cleanliness and speed up the adoption of contactless, biometric and ultimately more technological solutions within the customer journey.

- 61% think more frequent and deeper cleansing of shared facilities will last into the future

- 50% say contactless check-ins are expected to become the ‘new normal’

Source: Travelport quantitative research

Changes to Food and Beverage (F&B) Service

- Hotels are reviewing their F&B offerings, including mini-bar, on-site catering, room service, and event catering. They are adapting processes for ordering, preparing, delivering, consuming and paying for services.

Communicating on measures being taken

- Hotels are eager for as much of the information above to be made available to travelers at every stage of their journey.

- Some hotels are already using booking platforms and advertising services to communicate their cleanliness and hygiene policies and procedures. Many are using their own channels to give updates pre, during and post-stay.

- Hotels want travel agencies to continue to be the experts and voice of reason when discussing travel with customers.

- Overall, guest experience and clear communication will drive recovery.

What changes are being implemented to the booking journey as a result of COVID?

Communication is key!

- Over 90% of hotels are providing additional information throughout the customer booking journey.

- 86% are enhancing pre-arrival communications as a result of the pandemic to make travelers feel confident in staying at their venue.

Source: Travelport quantitative research

What is the most important value travel distribution partners can add for hotels at this time?

Communication again comes out strongly in our survey.

- 81% of hoteliers rank helping to keep travelers up-to-date highest (essential/highly important)

- 70% also ranked the sharing of booking and search data highly, seeing it as essential as businesses prepare their strategies for recovery.

Source: Travelport quantitative research

Maintaining flexibility:

- Hotels are keeping their amendment rates flexible to restore traveler confidence. It also encourages them to book with the assurance that if their ability to travel changes, they will not lose out.

- Hotels with loyalty programs confirmed they are pausing programs to allow members to maintain their status and points in a period they can’t travel.

- Hotels have prioritized protecting rate over driving volume of bookings. They believe cheap rates will not stimulate growth, especially with so much resting on local restrictions.

There’s a real understanding that the lack of demand at the moment is not that related to price levels. And so, as much as we’re see a gradual increase in occupancy, we don’t see to date that it’s at the expense of a massive downfall in average rates. We’ll have to see what happens over the next few months, depending on the curve of recovery. But I think overall as an industry, it wouldn’t help anyone to artificially support recovery through too drastic discounts.

What are the most common initiatives to drive consumer confidence? (short term vs ‘new normal’)

- 75% of hoteliers expect relaxed cancellation policies/rate flexibility to be the biggest driver in generating bookings in the short term as travelers look for reassurance in their travel plans.

- 55% expect longer term opportunities to be developed through key partnerships across the industry.

Source: Travelport quantitative research

What is the importance of maintaining a visible presence/marketing investment to stimulate recovery?

- 76% of businesses believe marketing will play an important part in restoring confidence to travel.

Source: Travelport quantitative research

Leveraging data:

- Our hotel partners have all identified data as being key to their recovery plans. There is a consensus that, because the landscape is changing so frequently, it is difficult to analyze data, but what data we do have is still very valuable.

- Hotels are using a range of data sources, from their own websites to partner booking platforms (OTAs, TMCs, GDS etc.). While accessing current booking data is relatively easy, many would like the forward view (searches), which is harder to obtain. Several chains are purchasing external industry data and would like greater access to airline booking patterns.

What data is predominately being used?

- Own website (100%) and OTAs (93%) are the prime data sources for understanding and planning for recovery.

- Over 70% are prepared to pay to access additional external reports, with over 55% of these already doing so to get an aggregated view of the industry.

Source: Travelport quantitative research

We’re starting to see some recovery for sure. We feel we are supporting this by articulating a customer-friendly cancellation policy and doing lots to reassure guests that it’s safe to stay in a hotel. And then we’re doing what we can to help travel agents articulate that to their customers.

03

Car

With many people opting to stay close to home, car rental is the ideal choice for domestic travel, offering consumers more control over their personal space, plus the ability to travel in isolation from others. This is an attractive alternative to both public transport and flying, for risk-managed travel right now.

Traveler research: Key findings

Restoring traveler confidence

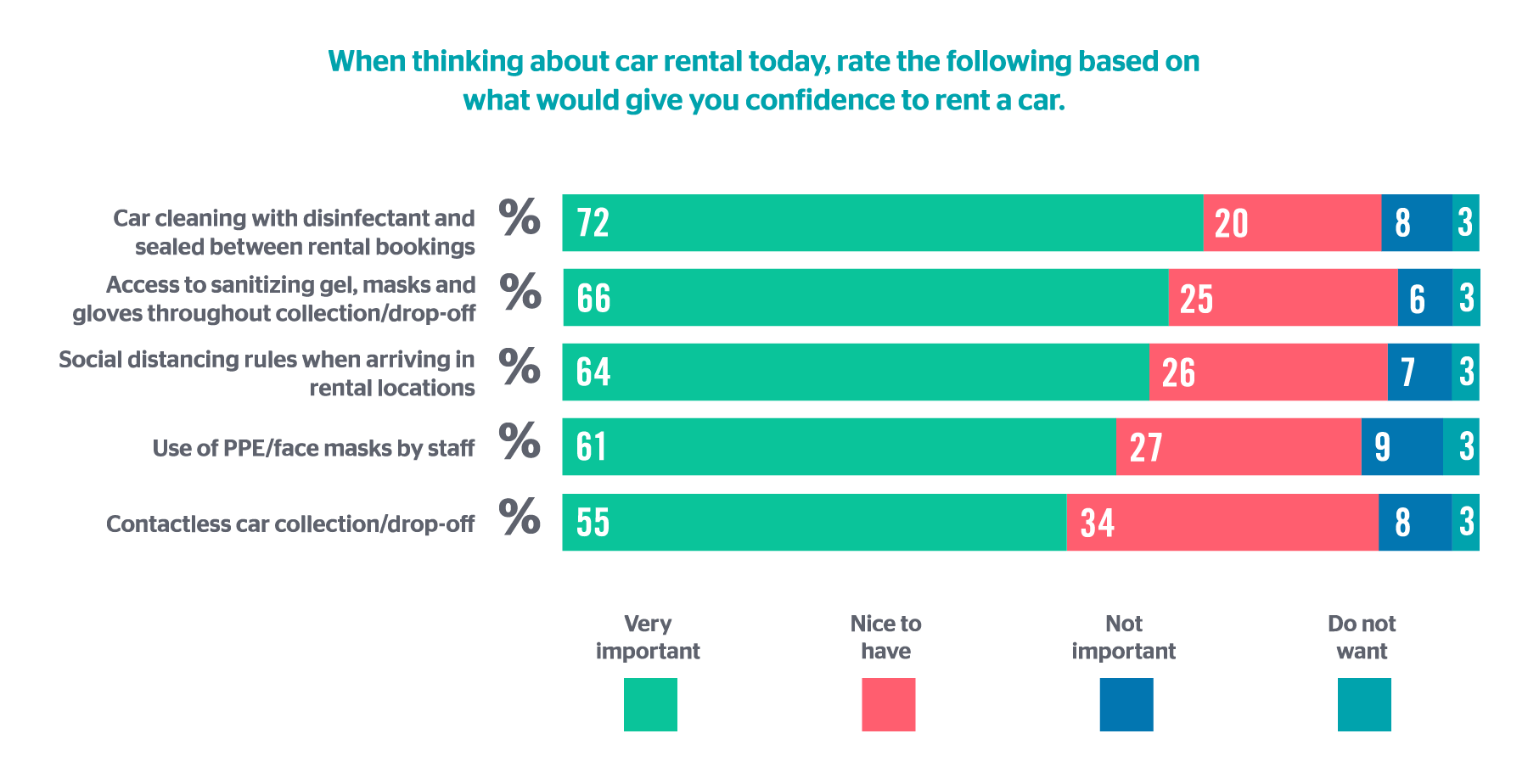

Like other areas of the industry, car rental companies are responding to traveler needs by implementing the highest standards of cleanliness and communicating this. These are the factors that people found most influential in giving them confidence to rent a car:

Sanitation/cleanliness

- Our research showed that a clean and disinfected car tops the list for 72% of people. Most of our car partners have implemented additional cleaning measures, with many sealing vehicles after sanitation. This gives customers peace of mind, as an unbroken seal indicates they are the first person in the vehicle since sanitization.

- Social distancing is very important for travelers, with 64% saying it would give them confidence to rent a car. Some of our car partners mentioned using plexiglass barriers at desks and disinfecting frequently touched areas such as counters and kiosks, and distancing lines for waiting areas.

- Most of our car respondents are providing staff access to PPE and additional cleaning equipment on-site, which 61% of travelers say is very important.

- Some are requiring customers to wear a mask on collection/drop off. They are also reassuring customers that cleaning products like disinfectant wipes and hand wash will be available.

- Our car partners are also more frequently disinfecting frequently used and public spaces, like waiting areas, removing items like books or newspapers to reduce the potential for transmission of COVID-19. Some are limiting the number of customers on the transfer buses that run between airport terminals and car rental stations.

- Several car rental partners indicated they would welcome industry regulation to provide mandatory measures that level the playing field to ensure a secure customer experience. However, it would need to be consistent in different cities, states, and countries.

Contactless traveler experience

- Travelers are showing some concern around interaction with people during vehicle collection/drop off. Almost all car partners interviewed also expressed an interest in reducing human interaction and the number of physical touchpoints required as part of collection experience by travelers. This includes efforts to increase use of self-service via mobile, tablet, or online to reduce the need for kiosk or desks, plus increased use of contactless payment solutions, with 64% of travelers saying social distancing in rental locations was ‘very important’ to them.

- Contactless collections are becoming even more important, and there is a desire to have all paperwork/insurance/selling done before the customer arrives. Car rental suppliers are promoting all contactless pick-up/drop-off and fast-lane style options to minimize time in rental locations. Companies will need to request additional customer information to enable this. And, 55% said that contactless was a ‘very important’ factor that would encourage them to rent a car.

- There is a renewed focus on digitizing key solutions and customer advance selections (e.g. specific car), as well as providing digital receipts at the end of rental, instead of paper versions, as standard practice.

Offering more flexibility and transparency

- Like other supplier types, car partners are hoping to drive bookings by extending flexibility in rates and cancellation/change policies. They recognize that this gives bookers assurance that their money is safe should the travel situation change before arrival.

- During our qualitative research, most of our car partners agreed that transparency is needed in communications. Providing insurances up front, and all pre-requisites of rental terms and conditions, will help create a fair playing field for price comparison (too many rates vary in their inclusions/exclusions).

- Our car partners also think that big corporates could support industry standards to push for transparency for customers. This will help to remove some of the frustration of bad customer experiences and hidden fees.

Recovery strategies

Communicating on measures being taken

- Car providers are eager for as much of the information above to be made available to travelers at every stage of their journey.

- Some car providers are already using booking platforms and advertising services to communicate their cleanliness and hygiene policies and procedures. Many are also using their own channels to give updates.

- Suppliers want travel agencies to continue to be the expert and voice of reason when discussing travel with customers.

Using data to identify recovery trends

- All of our car partners that discussed data identified it as being key to their recovery plans. There is a consensus that because the landscape is changing so frequently it can be challenging to analyze data for actionable insights.

- Car rental companies are using a range of data sources, from their own websites, to partner booking platforms (OTAs, TMCs, GDS). The general perspective is that accessing current booking data is relatively easy, but many would like the forward view (searches) which is harder to obtain.

- Several chains are purchasing external industry data and would like greater access to airline booking patterns, in particular. All of this can help providers understand more about who is traveling, where they are going, and more.

- With domestic travel showing the strongest signs of early recovery, and people taking different types of holidays to include more outdoor/activity-based holidays, there may be an additional opportunity for providers to appeal to this traveler segment. This may also be the case for travelers normally based in urban locations who do not own a car, and usually rely on public transport for taking trips.

Rate management:

- Many of our car supplier respondents are reluctant to use price as a long-term driver of demand due to the risk of starting a price war and inability to raise prices to a sustainable level. However, for budget car providers, driving the volume of bookings will take priority over protecting rate, as it will be essential to keep their fleet mobilized and earning, not sitting idle.

Changes to product offering

- Some car companies are driving demand using special loyalty promotions (like double points on rentals) and new product bundles, such as paying a one-off fee to access guaranteed benefits including a free additional driver, no young driver surcharge, fixed discount, reduced fuel prices, etc.

- One provider said that they may review their fleet mix to accommodate demand for ‘budget’ cars.

Focusing on ‘green credentials’

- One of the indirect outcomes of the pandemic has been an increased scrutiny on how it has benefitted the environment globally. Although right now car companies offer an attractive alternative to public transport and air travel, if car travel sees an exponential rise it is likely to be met with concern. To plan for this challenge, car rental companies are using this as an opportunity to focus on their ‘green credentials’ by offering a carbon offset, or increasing the number of electric cars in their fleet.

04

Destination

Marketing

The key role of destination marketing organizations (DMOs) is to promote their destination, to attract more visitors, to prolong visitor stays, and to increase traveler spend. During COVID19, these priorities have been changing. Now, as a trusted source of information for travelers, destination marketing organizations (DMOs) will be one of the driving forces behind recovery in the travel and tourism industries.

When the pandemic began earlier this year, DMOs had to creatively pivot their message, encouraging visitors to stay home. Now, as countries reopen for business, DMOs are helping to drive recovery by communicating the latest updates needed to entice travelers. This includes news on COVID-19 case numbers, entry and exit requirements, health screening, quarantine arrangements, as well as an increased focus on the traveler experience in their destination.

Restoring traveler confidence

Communicating health and safety measures

Like other areas of the industry, car rental companies are responding to traveler needs by implementing the highest standards of cleanliness and communicating this. These are the factors that people found most influential in giving them confidence to rent a car:

Sanitation/cleanliness

With cleanliness and hygiene measures emerging from our traveler research as the top influencing factors across air (71%), hotel (73%) and car (72%), DMOs are aware that communication and transparency will be important to guide and gently encourage potential visitors as they research their travels in more detail than before. This means using their channels to communicate what travelers should expect when coming to their destination, across all touchpoints of their journey. This includes guidelines on entry and exit, and information from airlines, hotels, car providers and key attractions.

Like other stakeholders in the travel ecosystem, DMOs recognize that the ability to return to ‘normal’ may only come back once a vaccine has been developed and issued. However, once their domestic market is stable — and at the same time if travel bubbles with other countries are established — they will start international market promotion.

Promoting a unique traveler experience

DMO campaign messaging is focusing on the ‘experience’ more than ever. They are promoting unique experiences, including natural wonders, hidden gems or off-the beaten-track attractions, plus less-known areas of their destination. DMOs are also finding creative ways to entice visitors, by suggesting alternatives to top cities where they can avoid crowds. They are similarly adjusting their message to more aspirational themes, such as ‘dreaming of travel’ and using emotive marketing to inspire people with future ideas to create a backlog of demand.

Offering more flexibility and transparency

Like other travel sectors, DMOs are facing new challenges, with perhaps the biggest being significant budget cuts. A recent report by Skift found that nearly 90% of travel marketers have cut their budgets, making it tougher to reach travelers. And as border restrictions lift, competition for audience is also increasing. However new ways of working are emerging, for example, joint destinations share resources, even with competitor destinations.

With a reduced budget, DMOs now need to develop new channels as well as optimize organic reach. Return on investment (ROI) and return on advertising spend (ROAS) will become increasingly important in campaign delivery. Similarly, DMOs will seek to maximize their free-to-air channels — including using social media and bloggers/influencers to attract visitors, PR campaigns, and travel articles. Our partners hope that they may also be able to save costs by repurposing existing content as ‘new’ when appropriate in the recovery cycle.

Collaborating with supplier partners

DMOs are cooperating with businesses in their destination to mutually promote a region/destination. This includes complimentary/co-promotion of activities, businesses, and regions — which is essential to deliver bigger exposure on smaller budgets.

Informing travel agents

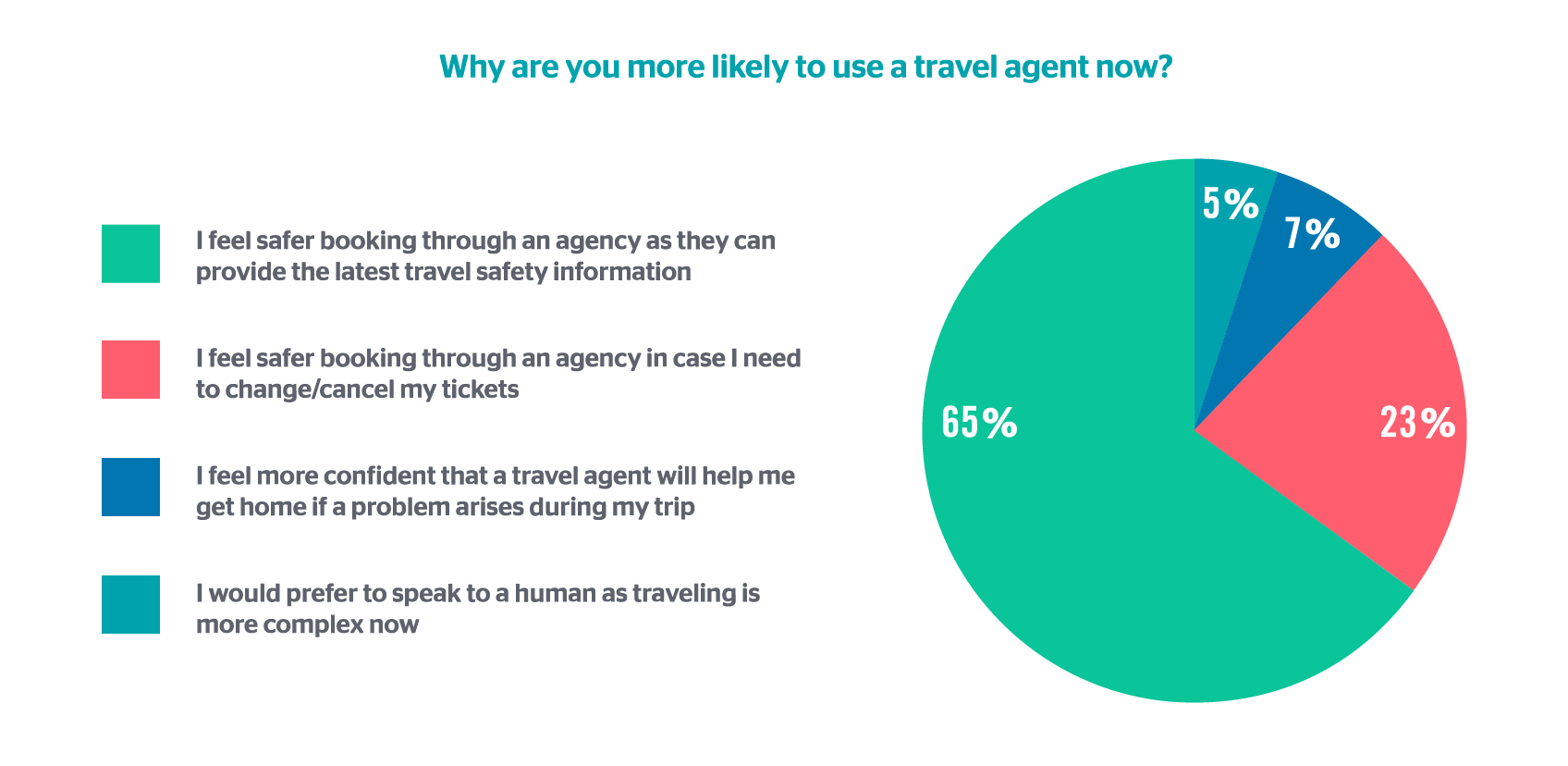

We know that travelers are turning more to agencies, with 65% doing so for their ability to provide reassurance and information in a post-COVID-19 world, and 23% for their ability to help change tickets. And, in our qualitative research with DMOs, almost all confirmed that travel agents are more important to them than ever too, in helping travelers during the dynamic and complicated recovery period.

DMOs want to help inform agents that now is the time to reinvigorate agent education programs, focusing on local regulations and safety measures as well as how to develop messaging to travelers. In countries where lockdowns are still in place, or have been reintroduced, this can be done via virtual events. Our DMO respondents believe that destinations that successfully achieve this will benefit when restrictions are lifted.

Securing government support

DMOs are advocating government support on two fronts. The first is funding. Some DMOs are government funded, and have suffered from marketing budget cuts in the wake of COVID-19. As mentioned above, DMOs rely on having sufficient budgets to use advertising to reach travelers. Communication is more important than ever, and DMOs can’t afford to fall behind, given the increasing competition for visitors.

DMOs also need government support to set up a coordinated approach across all touchpoints of a journey. This will make it easier for agents to advise travelers and confidently promote their destination to them.

Many DMOs are advocating ‘COVID-19-secure’ certifications for local businesses and properties. Large chains are leading the way on this, and DMOs are encouraging small, family-run businesses to follow suit and adhere to guidelines to get official recognition from governments and tourist boards. This would help both the supply and demand sides of the industry restore confidence and drive bookings.

Sustainable travel

One silver lining that is emerging from the COVID-19 pandemic is the environmental aspect of local tourism. There are a couple of elements driving this view. First, as people have had more time to assess their values, we are seeing a change in how they invest their time and money. Many used their time in lockdown as an opportunity to rediscover old (and socially distant) hobbies such as hiking, cycling, etc. and many want to continue this as part of their vacation/travel plans.

With restrictions lifting, sustainability will also be about supporting and protecting the local/regional businesses that provided vital services during lockdown, rather than global or multinational chains to whom they have less affinity. The hope is that by supporting local businesses, it may be possible to mitigate the localized impact of the economic recession predicted to follow the health crisis.

Using data to identify recovery trends

All DMO partners that discussed data identified it as being key to their recovery plans. There is a consensus that, because the landscape is changing so frequently, it is difficult to analyze data, but the data they have is highly valuable. DMOs are particularly interested in data insights from airlines and search patterns. They want to use this data to help identify new opportunities, segment packages, and identify how regional competitor destinations are performing and the activities they are promoting.

Travelport has been contributing to the data story by sharing destination data with DMOs so that they can better understand the situation, identify commercial opportunities, and make sound decision. This will help DMOs across APAC, EMEA, and the Americas regions understand more about who is traveling, where they are going, and more.

DMOs are finding creative ways to entice visitors, by suggesting alternatives to top cities where they can avoid crowds.

05

Travel Agencies

Having outlined how suppliers are responding to changing traveler needs, let’s look at what this means for travel agencies (agencies, OTAs and TMCs).

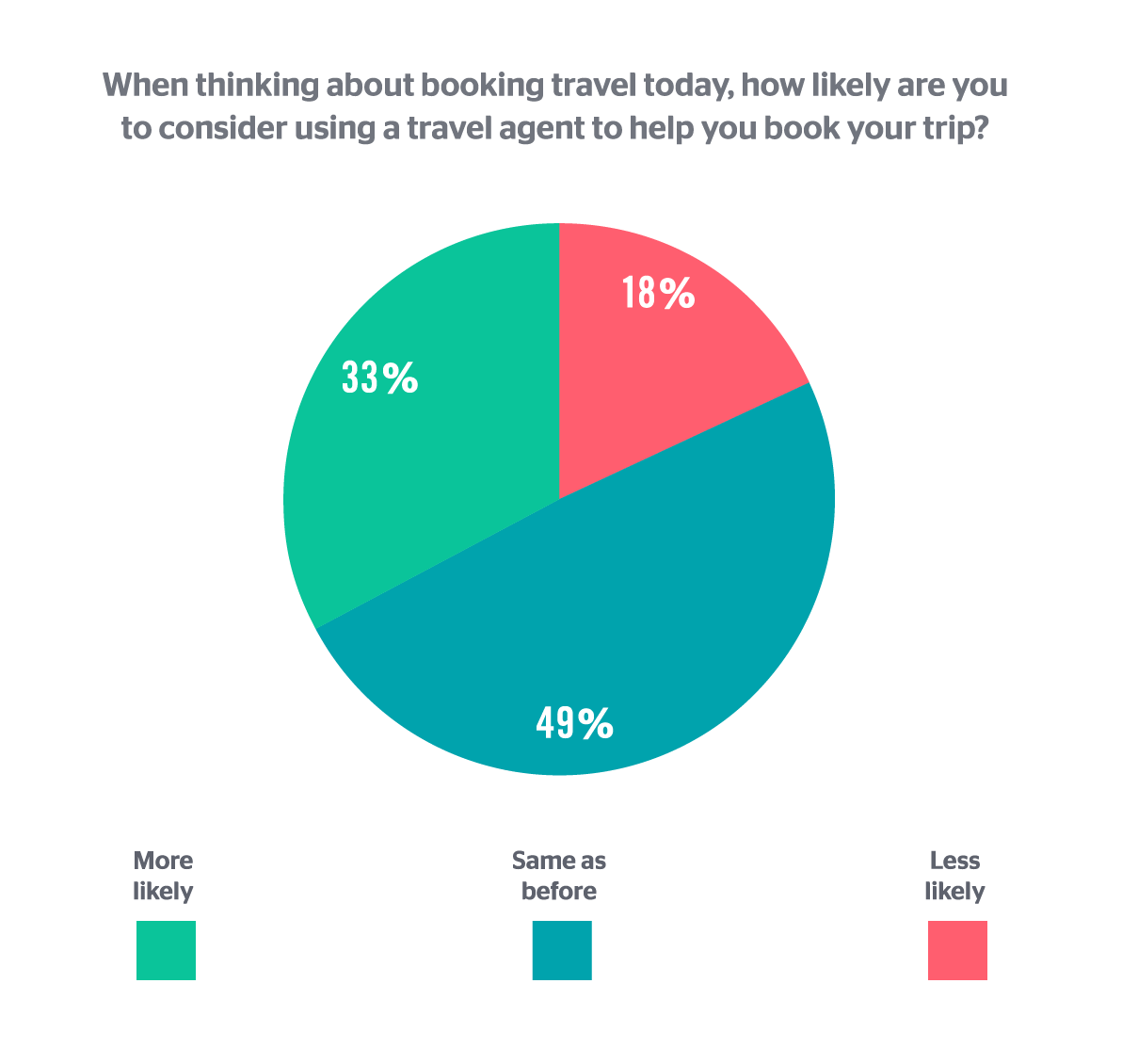

Since the beginning of the crisis, travel agencies have played a key role in acting as trusted advisors in a rapidly changing situation — providing updated policy information and facilitating journey changes and cancellations. And now that people are willing to travel again, the priority for agencies is shifting once more — to assure travelers that it is safe to travel. They are doing this by providing information on the supplier safety and hygiene measures that travelers confirm are key to influencing bookings.

Traveler research: Key findings

Overall, our findings suggest that people now value travel agencies more than ever in the booking process, and that — as recovery gets underway — they will have more influence beyond retailing alone. This will now extend to guiding travelers as they book and manage their journeys.

The COVID-19 crisis has made agencies more valuable to travelers

Travelers are choosing agents for the information and insight they can offer

Young travelers are most likely to now consider using a travel agency

Travel reseller recovery strategies

Keeping the results of our traveler research in mind, we wanted to investigate whether this aligns with what travel agencies are doing to drive recovery. We spoke to a large number of key agencies to conduct qualitative research to find out more.

agency customers recognize that, until a COVID-19 vaccine becomes available, safety measures are key to restoring confidence to travel again. They are complementing the initiatives taken by the supply-side of the industry through the following:

Communicating on safety measures, across all travel touchpoints

- We know that travelers want suppliers to implement higher safety and hygiene standards for flights, hotel rooms, and car rentals. Also of travelers more likely to use an agency, 65% stated it was because they can provide the latest travel safety information. This underscores how important it is for agencies to communicate what travelers should expect during a flight or trip.

- During our qualitative research, our agency customers told us that they are regularly connecting with customers and suppliers to broadcast updated information, like safety requirements, refund policies, and airlines’ anti-epidemic measures. Most agents also see this — together with government support in maintaining sanitation in common areas — as key to encouraging travel and ensuring customer loyalty.

- The challenge for agencies is to quickly find the information they need about these measures. Since this varies greatly per airline, agencies now need new tools within a modern platform that displays structured data including key safety and comfort features, such as temperature checks, mandatory mask-wearing, and reduced catering services — giving customers an idea of what to expect when traveling.

We need to better communicate with and advise our customers on what they need to be aware of [safety measures]. On the corporate side, we want to look at new ways to engage our customers from a digital perspective, to enable their bookings and for arrangements to be a lot more coordinated.

Adding value by simplifying journey management

As travel restrictions came into effect, travel agencies and TMCs faced an unprecedented operational challenge: dealing with the huge volume of booking cancellations and change requests. They also struggled to stay on top of regularly changing supplier policies (like cancellation, change, and refund policies; plus, more recently, safety requirements), and to communicate all of this back to their customers. Throughout this time, agents have depended on access to information to navigate the constantly changing situation, and have been using designated tools to improve operational efficiency.

When it came to managing airline refund and exchanges, we got a big influx of calls where passengers were worried about what was going on and what their options were. We created a portal that our agents could log into with details of the airline policies that was backed up by what Travelport did with their COVID-19 airline policy tool.

Preparing for a new era in travel

The COVID-19 crisis has seen numerous changes take place across the demand side of the travel industry. Like many areas, this has, unfortunately, included headcount reduction, meaning that many agencies are now operating with fewer resources as they head into recovery.

To manage this, travel agencies have told us that they are investing in personal development for staff, including training. They believe this will make it will be easier for their businesses to get back up and running, and improve the operational efficiency needed to help make up for business lost over the past few months. They are also looking for ways to automate processes throughout their workflow, to support transactions requiring fewer, or no, human interaction. This aligns with the broad desire expressed by travelers for more contactless processes across all touchpoints when it comes to managing their journey.

Finally, with more agents working from home, this means they now need more capabilities in their mobile booking interface, supporting PNR and ticket management and modification.

In Singapore, there’s really no domestic travel for us. So, during phase one of the pandemic, that meant literally no travel. I think during that time a lot of agencies were looking out for ways to stay close with our customers, looking at opportunities to digitize some of our businesses and processes, and hopefully also at new opportunities rising up from this current crisis.

We anticipate that our customers’ expectations are going to change, in some cases becomeing challenging when we get through this recovery. So, we have to balance our ability to really meet their needs while also managing cash flow, because I’m convinced there will be a recovery, and those that are prepared for it will continue to succeed post COVID-19. With usual business levels significantly down. Fox actually sprinted on quite a few of our pre-COVID-19 strategic planning initiatives — like improving our automation, increasing efficiencies when it comes to not only our internal processes, but the customer-facing processes as well. We also spent a tremendous amount of time enhancing our automation for the exchange process when we go to apply all of those tickets to future travel

Using data to identify recovery markets and commercial opportunities

Agencies are using a range of data sources to gather information around recovery and identify new opportunities, including:

- Sales data: Most agencies are using their own sales data, together with some government and industry (e.g. IATA) data, to track and plan recovery, and to compare performance with their competitors.

- Suppliers: Agencies tend to get data from suppliers (e.g. airlines and hotels), as well as survey studies and trend reports.

- Identifiers: Some are using identifiers, like destination or length of travel, to understand demand for certain types of trip.

- Quarantine requirements: A small number of agency respondents said they collect information about which countries require quarantine to predict travel patterns. They predict more people will travel to a country for non-essential trips when the quarantine policy is lifted.

- Booking platforms: Booking platforms can provide travel agencies with valuable week-over-week booking information to help them identify recovery trends and travel patterns. Booking platforms can also be a convenient source of information and data. With additional demands and reduced resources, more than ever, agents now need tools within their GDS platform to avoid leaving their workflow.

This includes tools and features to find out the latest updates on airline policies, safety measures, government restrictions on travel (including lockdown-level indicators, quarantine measures, health certificates, and safety precautions). Since these are constantly changing, when this information is not available in the GDS, it puts added pressure on already reduced resources and creates inefficiencies in workflow. Travel agents often need to look at many different sources for the most up-to-date information before making a booking.

Driving demand

With many travelers’ first port of call being to visit family and friends, it is important that travel agencies focus their targeted marketing proposition on fares and offerings. Agents need to understand the needs of this specific type of traveler and tailor their offers to suit them.

For example, a traveler making a trip to see family and friends may be more interested in extra baggage options, they may have accommodation arranged already with friends and family, but if they do not, the end destination targeting will be less about the hotel itself and more about the location being near to their friends and family. To deliver this level of targeting, agents need to better the traveler’s motivation for the trip and support more specific hotel location search results. While journey management may become more automated, during booking, travelers are more likely to want to talk to the agent to get a better understanding of what their journey will look like. For offline agents, this means their staff need to have all the information at hand. And, online agent websites need to contain the content to support the customer.

In addition to driving demand through communication, our agency customers are also pre-selling promotions with hotel partners, offering packages with a special insurance inclusion and free cancellation policy, and promoting winter holiday season travel. Some agencies think that eliminating travel bans, along with promotional deals would help to drive travel too.

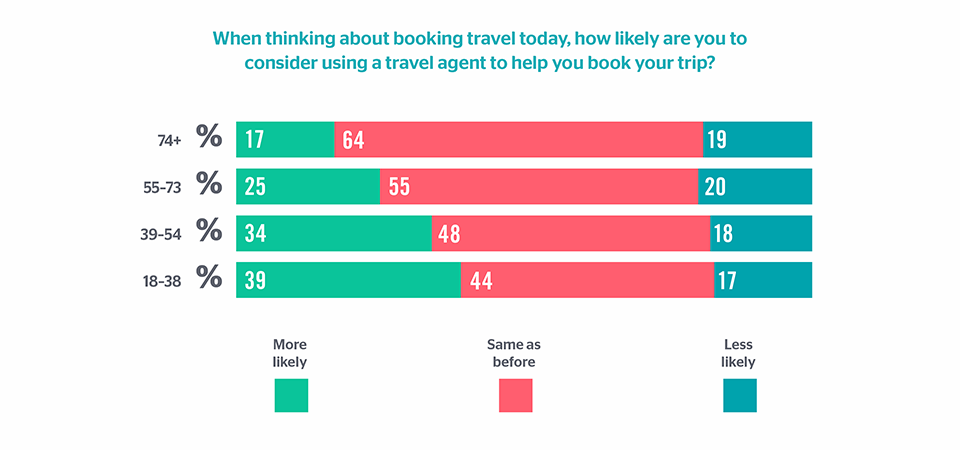

33% of people are now more likely to book using a travel agent, with 82% being either more likely or the same as before.

06

Recovery

Expectations

This section of our recovery guide contains insights and perspectives that our supplier and agency partners shared with us during qualitative and quantitative research. We have used this information, along with Travelport’s own data, to identify emerging trends and potential commercial opportunities below.

Communication, communication, communication

- Across the industry, we are seeing that communication plays a critical role in rebuilding traveler confidence. Our research has shown that safety and hygiene measures are the key to encouraging travelers to book flights, hotels, and car rentals again. So, it follows that suppliers must continue to implement, document, and communicate to travelers the actions that they are taking — directly and via travel agencies — as recovery takes shape.

Domestic travel showing strongest signs of recovery globally

- Until there is more certainty around borders remaining open and people becoming more confident in international travel, domestic travel will drive recovery initially. Unhampered by quarantine restrictions, and in many countries, often by car, travelers are likely to consider domestic travel the safer and less complicated option.

- Our data shows domestic travel is growing at a rate of 50% per month, averaging the prior three months, although growth from June to July has slowed. The geo bound mix has shifted significantly with domestic travel doubling after the pandemic (domestic mix was 20% in Q1 and now 40% in Q2).

- For travel agencies, hotels, and car suppliers, this presents retail opportunities as travelers take trips within their domestic market. In larger countries, like the US, Russia, China or Australia, they may also be able to benefit from domestic air travel — certainly Russia is already seeing a large spike in domestic demand. All of this requires data analysis on where travelers are going, traveler personas, and the type of trips they are taking.

- Our partners expect the US to be first to recover, despite the recent spike in new cases, given its large domestic market. Of this, it is expected that essential business/work-related stays will continue (first responders, grey collar workers), followed by visits to friends and family. They expect groups/conventions to be last to recover.

- All-inclusive resorts may replace demand for cruises, and our partners are closely monitoring leisure attractions such as Disney parks and the decisions taken around the NBA and NFL. Respondents expect these to be some of the first drivers of demand.

- Europe is likely to benefit from close international cooperation to deliver regional recovery, resulting in less restrictions on travel. As we’ve seen in the US though, increased movement of people may mean further spikes in cases which would make overall recovery more complex.

- Full international travel is expected to be the last to return, as so much relies on the development of the pandemic — which is still in constant flux. Airlines are seeing and expecting more travel ‘bubbles’, ‘bridges’ and ‘corridors’ to appear, where countries group together to allow people to travel with looser entry and exist requirements, based on the risk level. For example, the UK had adopted ‘traffic light’ based travel corridors, while Singapore has developed Green Lanes. But the situation is changing day by day, and there is equally the possibility of travel bridges collapsing if case numbers rise in destinations.

- However, the positive news for travel businesses is that the World Health Organization (WHO) recently agreed that travel bans cannot stay in place indefinitely. This shows that the focus is slowly shifting from lockdowns to suppressing the virus while allowing economies to open up.

Leisure recovering faster than business

- There is a broad view across the industry, and echoed by Travelport’s CEO Greg Webb, that there is a pent-up demand for leisure travel following months of lockdown. The expectation is that this will be acted on by leisure travelers before business travelers, as they have more autonomy over travel choice. Of this, our partners’ view is that visiting friends and relatives will start the recovery, as people look to see loved ones after lockdown. Repeat visitors that have a connection to/are familiar with the destination in question are likely to be the next to travel.

- As the world has adapted to working from home and less in-person interactions, business travel will likely make a slower return. Within this sector, hotels are expecting SMEs to return before large corporates. Our hotel partners expect recovery for Meetings, Incentives, Conferencing and Exhibitions (MICE) to take the longest.

The corporate world, of course, is not one homogenous bunch. The booking patterns among small and medium enterprises tend to be closer to leisure customers in the sense that you have decision makers who need face-to-face interactions in order to get stuff done — and so that type of business travel is recovering. But we see a lot of prudence on the part of the larger corporations, who have different policies and there’s much more caution there. Business is based on trust and face-to-face meetings are important at some stage — this is irreplaceable. We’ve proven to ourselves we can do less in terms of face to face interactions — but less is different to zero.

- Our agency and supplier partners also think that activities where social distancing is easy to achieve, like diving or fishing, are in a good position to recover quickly. They believe that disposable income will influence which groups recover first – i.e. those who have been less impacted economically by COVID-19, like retirees on fixed income, government workers with guaranteed income, or millennials who want to travel regardless.

We’re definitely seeing leisure travel coming back much quicker than corporate. We’ve spoken to both sets of customers — and for leisure the demand is there. They want to travel, that’s the good news. And you can tell that by the search trend. It’s when it comes down to actually booking they have worries about where can they travel to, what’s it going to be like, and are there going to be future lockdowns with travel bans in place? With corporate it’s about 50:50. People want to travel, but it’s the businesses holding back for insurance purposes, and employee safety

Predictions around traveler segments and motivations:

- Both suppliers and travel agencies generally expect younger people to travel sooner and expect that people over 60 years will be slower to return to the air.

- Unsurprisingly, given the emphasis on social distancing, group travel is expected to be the very last to recover across the industry.

Continued flexibility on price and policy will be required

- Almost all partners identified price flexibility as key to supporting demand and giving reassurance to bookers that their money is safe should the travel situation change.

- People are aware that the outlook is uncertain for some airlines, as this has been widely covered in the media. For this reason, being a trusted brand will be more important than ever to encourage people to book new trips or accept vouchers instead of cash for cancelled flights.

Our qualitative research showed that there is a split of views among suppliers over budget/premium brands and offers:

Budget: There is some expectation that budget brands/products will benefit more in the early recovery due to the economic impact seen by many customers. Another view is that budget brands will need to rely on promotions and offers to drive demand. Partners predict that in any economic recession to follow the health crisis, inexpensive brands will fare better than premium.

Premium: Some are concerned over losing high value customers booking premium products, as these could be impacted by a shift in channel to slightly more affordable alternatives. The opposing view is that this segment would be more willing to continue to pay a premium if cleanliness policies/sanitation was guaranteed.

Data to play a key role in recovery

- All agency and supply partners that discussed data during our qualitative research said this is key to their recovery plans. Data will play a crucial role in identifying trends and seizing commercial opportunities.

- Sources of data range from suppliers’ own websites to partner booking platforms (OTAs, TMCs, GDS, etc.). The view is that accessing current booking data is relatively easy, but many would like the forward view (searches), which are harder to obtain. Several partners purchase external industry data and would like greater access to airline booking patterns.

Duration of safety measures/recovery timelines

- The view from our agency and supply partners is that a full return to normal will not happen before a global vaccine or effective treatment is available, so until that becomes a reality, the safety measures that are being implemented are key to initial recovery. The industry overall is expecting to see a ‘new normal’ happening in 2020, with a full recovery being longer term. Most responses from suppliers have indicated that any relaxation of measures taken are likely to depend on regional restrictions being reduced by governments, which could lead to variances.

- There is a significant uncertainty on recovery growth rates and timelines, especially if the health crisis becomes a broader economic crisis. Some airlines are predicting 3-5 years before a return to pre-COVID-19 levels. In July, IATA released an updated global passenger forecast predicting that global passenger traffic will not return to pre-COVID-19 levels until 2024, a year later than previously projected.

- However, from our research we are seeing that travelers are responding positively to the new safety and hygiene measures that airlines are implementing, with 71% saying that an enhanced cleaning program during and between flights would encourage them to book a flight, and 64% saying that flexibility on ticket refunds/cancellations would encourage them to do so too.

What shape, and over what timeframe, do you think recovery will look like for your airline? Will recovery happen at a different pace for different customer types, travel types, regions?

- 41% think it will take between 3-5 years for a full recovery, with a further 33% being slightly more optimistic at 2-3 years.

- Almost 20% think that the new normal will be arrived at within 3-6 months, although 37% are expecting it to be 1-2yrs

- Contrary to the views expressed in the media, 66% of the respondents envisage business and leisure returning at approximately the same rate within the next 2 years, with SMEs lagging behind by approx. 10 percentage points.

- As expected, their views affirm the view that the younger generation will be ready to fly sooner, and also families slightly more risk inclined.

Source: Travelport quantitative research

What shape, and over what timeframe, do you think recovery will look like for your hotel? Will recovery happen at a different pace for different customer types, travel types, regions?

- There is a positive view in the hotel industry around a full recovery, with 77% expecting this to be achieved in less than 3 years.

- 32% expect a new normal to be established in less than 12 months, with 42% expecting domestic travelers will be ahead of that curve.

- There is consensus that leisure (52%) will return to normal ahead of business (26%) in the first year and that families (19%) and solo travelers (21%) will be the first customer segments to return within 3-6 months.

Source: Travelport quantitative research

- From Travelport’s own data, we are seeing encouraging signs of recovery with countries across the world reopening. This recovery is unlikely to be linear, with peaks and troughs of progress to be experienced along the way. For example, as we have seen in the US, recovery may start off strong but experience setbacks as case numbers spike. In some regions, lockdowns may even be reintroduced or regress through stages of reopening.

Online retailing to grow in importance for travel agencies

- It’s clear that having a strong online presence and digital strategy will be more valuable than ever from now on. This is backed up by data, with OTAs showing the strongest signs of recovery globally.

- With online growing in importance, agencies are likely to increase their focus on marketing and digital advertising. This will require guidance to maximize the effectiveness of their campaigns.

- With 39% of 18-34-year-olds showing an increased interest in using a travel agency, this presents new commercial opportunities for travel agencies.

- Interestingly, our traveler research showed that only 5% wanted to book through a travel agent because they preferred the human interaction. This doesn’t imply that people don’t want to speak to someone in-person, but rather that it’s relatively less important than their ability to change a ticket.

- Booking check, change, or consolidation are key draws for travelers to use an agency (23%). So, going forward, offline agents that provide customized services could stand to gain customer confidence by comparison.

06

Accelerating

Recovery

We’ve reached the end of our guide, and hopefully you have found the results of our qualitative, and quantitative research spanning travelers, suppliers and agencies both insightful and valuable.

Some of the main conclusions that we can draw

- Most travelers are ready to consider booking international and domestic trips as long as airlines, airports, hotels, and car rental companies collectively implement stringent safety measures throughout the travel ecosystem.

- In general, the safety and hygiene measures that suppliers are implementing are aligned to what travelers expect in order to feel confident in travel again. So now, documenting and effectively communicating these measures is key to enabling travel agencies to guide and advise bookers.

- Travelers also want the flexible cancellation/refund policies that were offered at the beginning of the pandemic to continue, and this will also play an important role in giving them the confidence them to book.

- Domestic travel is returning fastest, and leisure is making a faster recovery than business travel. These are where the first commercial opportunities lie in recovery.

- Views on pricing vary, but overall, suppliers are using strategic dynamic pricing to balance driving demand with profitability.

- Recovery in markets around the world is unlikely to be linear, with countries experiencing peaks and troughs of progress as cases numbers rise and fall. This will cause markets to recover at different rates. Data is key in enabling all stakeholders to adapt quickly to changes and to identifying emerging recovery markets.

- The supply and demand sides of the travel industry recognize the need to work together to collectively restore traveler confidence and help drive recovery.

Working together to accelerate recovery

Based on our quantitative and qualitative research conducted with travelers, our agency customers, and supply partners, we believe the industry can work better together in the following ways:

How can suppliers facilitate agency sales?

- Thoroughly document their safety and hygiene measures and communicate this regularly to agencies.

- Standardize where possible — what are the health and safety attributes each sector (airlines, hotels, car renters, airports, destinations) can define and communicate in a consistent way, e.g. mask wearing, contactless technology, enhanced cleaning, social distancing, temperature checks.

- Stay flexible on policies and pricing to reassure travelers that their money is safe even if their ability to travel changes. Be honest and transparent about refund/exchange policies.

- Share promotional deals to attract people to book and travel — rekindle the desire to travel.

- Deliver reliable and accountable customer service and follow-up.

- Work closely with trade and tourism partners on how to get each country moving again.

How can agencies help to drive supplier recovery?

- Communicate supplier safety and hygiene measures across the travel journey.

- Reassure travelers about change/cancellation policies.

- Inform travelers about the entry/exit requirements for their travel destinations.

- Communicate offers from travel providers to drive business growth

What can destination marketing organizations do?

- Communicate destination entry/exit requirements measures.

- Co-promote key events that may encourage people to travel.

- Be transparent about local conditions and measures in place to build consumer confidence and trust.

- Encourage governments to deliver solutions for measures like temperature checks, and for this to be a coordinated action between all travel suppliers and governments on an international scale.

What can distribution companies like Travelport do?

- Act as conduit for suppliers to provide and communicate safety and policy information through booking platforms and merchandising technologies.

- Provide tools to agencies to enable them to optimize their workflow, such as resources concerning safety information.

- Work with the industry at large to enhance digital and mobile strategies, including new ways to minimize customer touchpoints.

What is the most important value travel distribution partnerships can add for travel suppliers at this time?

- 43% of all air respondents deemed keeping travelers informed on the latest developments to be most essential.

- 81% of hoteliers rank helping to keep travelers up to date essential or highly important.

- 42% of air respondents view communication of promotions and offers being almost as essential.

- 36% of air respondents cited responsive technology changes as essential.

- Interestingly, the provisioning of NDC to provide better product visibility was ranked as the 4th most essential for air respondents. Airlines with an NDC program told us they see it as more important than ever, although as previously mentioned, this may see temporary delays while airlines focus first and foremost on recovery.

- 70% of hotel respondents said that sharing booking and search data was essential or highly important to preparing their recovery strategy.

Source: Travelport quantitative research

And finally...

All stakeholders across the industry must continue to share their knowledge, data, recovery success stories and more to ensure that we emerge from this crisis stronger than before.

We’re all experiencing this — but from different angles. So, let’s all keep building our understanding of what those angles are, and how we can work together to navigate our way through this unchartered territory, and overcome the challenges that lie ahead us.